Double declining balance depreciation allows for higher depreciation expenses in early years and lower expenses as an asset nears the end of its life. The DDB depreciation method offers businesses a strategic approach to accelerate depreciation. When it comes to taxes, this approach can help your business reduce its tax liability during the crucial early years of asset ownership. Some companies use accelerated depreciation methods to defer their tax obligations into future years.

What is the Double Declining Balance Depreciation Method

By applying the DDB depreciation method, you can depreciate these assets faster, capturing tax benefits more quickly and reducing your tax liability in the first few years after purchasing them. DDB is best used for assets that lose value quickly and generate more revenue in their early years, such as vehicles, computers, and technology equipment. This method aligns depreciation expense with the asset’s higher productivity and faster obsolescence in the initial period. AI-powered accounting software can significantly streamline these depreciation calculations. By automating the complex calculations required for methods like DDB, AI ensures accuracy and saves valuable time.

Double Declining Balance: A Simple Depreciation Guide

On the other hand, with the double declining balance depreciation method, you write off a large depreciation expense in the early years, right after you’ve purchased an asset, and less each year after that. So the amount of depreciation you write off each year will be different. With the double declining balance method, you depreciate less and less of an asset’s value over time. That means you get the biggest tax write-offs in the years right after you’ve purchased vehicles, equipment, tools, real estate, or anything else your business needs to run. Depreciation is an accounting process by which a company allocates an asset’s cost throughout its useful life.

Microsoft® Excel® Functions Equivalent: DDB

The formula used to calculate annual depreciation expense under the double declining method is as follows. The steps to determine the annual depreciation expense under the double declining method are as follows. For example, the depreciation expense for the second accounting year will be calculated by multiplying the depreciation rate (50%) by the carrying value of $1750 at the start of the year, times the time factor of 1.

Debit vs. Credit Differences in Accounting: Rules and Examples

This method accelerates straight-line method by doubling the straight-line rate per year. The double declining balance method accelerates depreciation, resulting in higher expenses in the early years, while the straight line method spreads the expense evenly over the asset’s useful life. Each method has its advantages, suited to different types of assets and financial strategies. Double Declining Balance (DDB) depreciation is a method of accelerated depreciation that allows for greater depreciation expenses in the initial years of an asset’s life. A double-declining balance depreciation method is an accelerated depreciation method that can be used to depreciate the asset’s value over the useful life. It is a bit more complex than the straight-line method of depreciation but is useful for deferring tax payments and maintaining low profitability in the early years.

To learn how to handle these contingencies, please see our Beginner’s Guide using the above link. In year three, the amount that would be generated by Straight-Line at that point in time would be the depreciable cost, which is now $3,600 divided by three as we only turbotax tax return app en app store have three years left in the assets life. Tickmark, Inc. and its affiliates do not provide legal, tax or accounting advice. The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations.

When comparing an early accounting period to a later one, the double declining method has higher expenses earlier in the asset’s life. Choosing the right depreciation method is essential for accurate financial reporting and strategic tax planning. The double declining balance method offers faster depreciation, suitable for assets that lose value quickly, while the straight line method spreads costs evenly over the asset’s useful life. Depreciation is the act of writing off an asset’s value over its expected useful life, and reporting it on IRS Form 4562.

It was first enacted and authorized under the Internal Revenue Code in 1954, and it was a major change from existing policy. Various software tools and online calculators can simplify the process of calculating DDB depreciation. These tools can automatically compute depreciation expenses, adjust rates, and maintain depreciation schedules, making them invaluable for businesses managing multiple depreciating assets.

- When you run a business, you have to be aware of the useful life of your assets.

- Here’s the depreciation schedule for calculating the double-declining depreciation expense and the asset’s net book value for each accounting period.

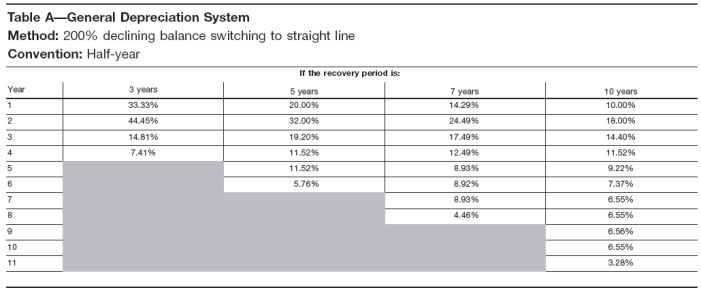

- Financial accounting applications of declining balance are often linked to income tax regulations, which allow the taxpayer to compute the annual rate by applying a percentage multiplier to the straight-line rate.

- To get a better grasp of double declining balance, spend a little time experimenting with this double declining balance calculator.

The book value of an asset, seen on the above chart, is the asset’s original cost, less any accumulated depreciation. Any impairment (weather, fire, accident) that may befall an asset is also subtracted. To record the depreciation expense each year for this asset, we enter a journal entry that debits Depreciation Expense $4,000 and credits Accumulated Depreciation $4,000. As you can see in the previous chart, the depreciation expense using the Double-declining method in year four was $864, so we have a winner! The mathematics of Double-declining depreciation will never depreciate an asset down to zero.

Increase your desired income on your desired schedule by using Taxfyle’s platform to pick up tax filing, consultation, and bookkeeping jobs. In addition, capital expenditures (Capex) consist of not only the new purchase of equipment but also the maintenance of the equipment. Yes, businesses can switch methods if they find another one suits their needs better. Under IRS rules, vehicles are depreciated over a 5 year recovery period. Double declining balance depreciation isn’t a tongue twister invented by bored IRS employees—it’s a smart way to save money up front on business expenses.

Because depreciation, ultimately, reduces taxable income, we want to depreciate each asset down to zero or expense money is left on the table. In year one, the depreciation expense is twice that of the straight-line method, or 2/5 (40%) of $10,000, which equals $4,000. That’s a hefty depreciation expense, but that’s what Double-Declining depreciation is all about. This can make profits seem abnormally low, but this isn’t necessarily an issue if the business continues to buy and depreciate new assets on a continual basis over the long term. At the beginning of the second year, the fixture’s book value will be $80,000, which is the cost of $100,000 minus the accumulated depreciation of $20,000. When the $80,000 is multiplied by 20% the result is $16,000 of depreciation for Year 2.